Is Chelsea’s Spending and New Boehly Business Model the Future of Football/Soccer Transfer Strategies?

Introduction

Todd Boehly and his consortium took over at Chelsea in May 2022 from the long standing Roman Abramovich. We explored this in a previous blog and it was clear that there were some big boots to fill on the back of Abramovich’s success over almost 20 years. Since then, Chelsea’s unique transfer business has been discussed at length throughout the busy summer window; through an unprecedented January window, including the deadline day Premier League record-breaking signing of the 22-year-old Argentinian midfielder, Enzo Fernandez and continues to be a popular topic for football pundits and experts.

In this blog, we will first look at the extraordinary summer and winter windows for Chelsea since Boehly’s takeover and attempt to outline their new strategy to football transfers. We will then analyse the compatibility of Chelsea’s activity with the financial fair play regulations that are enforced by UEFA as well as independently by the Premier League and explain how Boehly has managed to successfully navigate these rules without facing serious consequences; before considering whether this kind of business model will have an impact upon the future of the football transfer market.

The Boehly Business Model

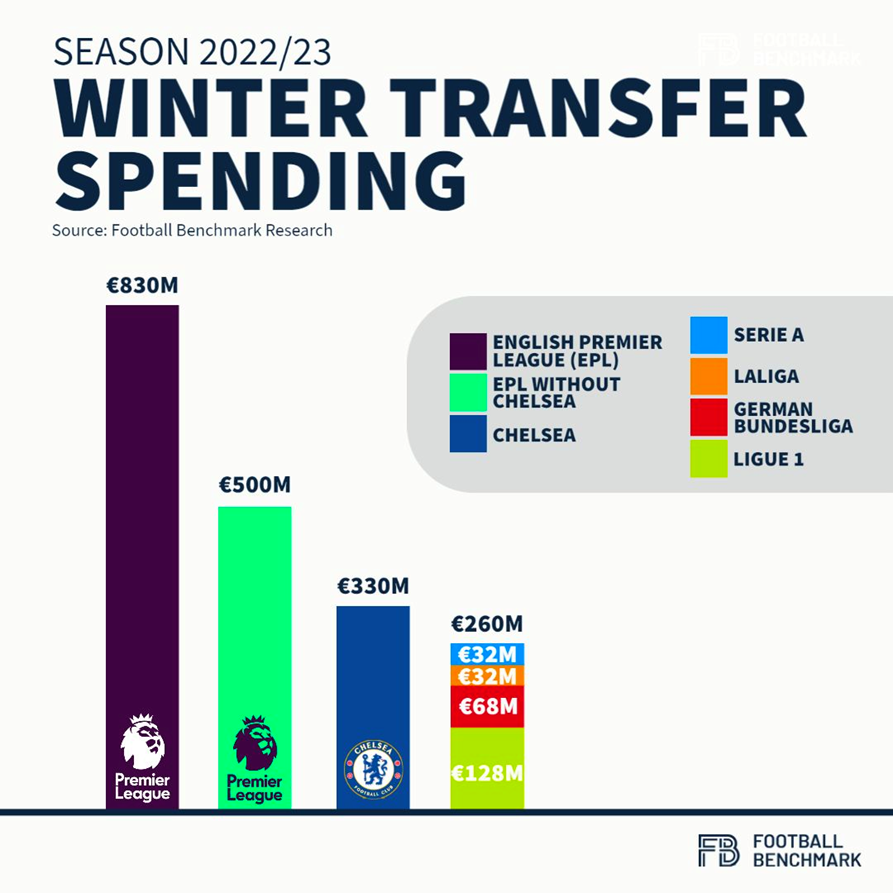

The unprecedented approach to football transfers of Todd Boehly is demonstrated quite simply by considering the figures involved in Chelsea’s business over the last two transfer windows (summer 2022 and winter 2023) and put into context against the more ‘normal’ numbers of other clubs and leagues:

- Boehly has spent £600m on 18 players since the May 2022 takeover. In context; the second highest spenders during this time, Manchester United, have spent £373m less (£227m).

- The entirety of the Bundesliga, the German top tier, has spent a total of £605m during the same period. In the January window that closed last week, Chelsea spent £322.1m on eight players, including breaking the Premier League record by buying world cup winning youngster, Enzo Fernandez, from Benfica for £105m.

- In context: as we explained in a previous blog, loan deals are far more prominent in the winter window. In the 2022 equivalent, Premier League clubs spent a total of £322.9m, which has almost been matched by Chelsea alone.

- The extraordinary spending of Chelsea and its impact on the global football market is best demonstrated in the graph below:

- During this time, Chelsea have only received an income of around £60m, producing a loss of over £500m since Boehly’s business model began.

- This includes major losses made on players such as Timo Werner (bought for £50m, sold for £20m), and Romelu Lukaku (bought for £95m, loaned back to Inter Milan).

- Chelsea also lost big names as their contracts ran down and they left as free agents including Antonio Rudiger, Andreas Christensen and Marcos Alonso. This was no fault of Boehly’s as it was the previous board who had allowed their contracts to expire.

The 2022 summer window showed the intent that Boehly had with Chelsea. More experienced big names such as Raheem Sterling (£56m), Kalidou Koulibaly (£32m) and Pierre-Emerick Aubameyang (£12m) joined alongside younger, high potential recruitment targets such as Carney Chukwuemeka (£15m) and Wesley Fofana (£80m). The recent January window was much the same; most notably the signings of Mudryk, Fernandez and João Felix (£11m loan) and three other 19-21 year-olds for fees between £30 and £40 million.

As part of Boehly’s business strategy, he has also restructured the recruitment system at Chelsea. The likes of Laurence Stewart, Joe Shields, Paul Winstanle, and Christopher Vivell have been added to the club’s board to bolster their expertise in the football recruitment department. However, as well as the seemingly limitless spending on new signings, there is another major shift in Chelsea’s approach to transfers under Boehly which has occurred for a very good reason…

Navigating Financial Fair Play

One of the most repetitive questions posed when discussing the recent activity of Chelsea in the transfer market is how can they spend such a vast sum, with such little income, whilst also adhering to financial fair play rules?

As we have explained in our previous financial fair play blog, the latest UEFA FFP regulations allow clubs to make a loss of £50m over three seasons, whilst the Premier League adopts a more relaxed approach, allowing £105m in losses over the same timeframe. Hence, in light of Chelsea only receiving £60m income from outgoing transfers, the extortionate discrepancies in their profit and loss reports seems as though it should infringe upon financial fair play. Yet, one of the most notable components of Chelsea’s and Boehly’s strategy changes is offering longer-than-usual contract lengths to their new signings in a process that helps them to ‘amortise’ the costs. Put simply, Chelsea have identified a ‘loophole’ in FFP regulations and by navigating around it in this way will prevent them from breaching any rules and ultimately, they will avoid any penalties for illegal infringements.

Amortisation is a term used to describe the spreading of costs. In the context of Chelsea, they have offered lengthy contracts to players and will pay their transfer fees in instalments over this time. This helps them to balance the books and significantly reduces their annual losses. Rather than a typical contract length of three years, maybe up to five years maximum, Chelsea have exceeded this in many new signings to redistribute transfer payments over a longer period. This is seen in practice as follows:

Mykhaylo Mudryk’s EIGHT-AND-A-HALF-YEAR contract means that Chelsea will pay Shakhtar Donetsk around £8m per-year (plus add-ons) over this time to eventually pay off the £70m transfer fee. The authorities that enforce Financial Fair Play rules will be presented with the annual financial reports that will only show this £8m figure against Chelsea’s books. Notably, for a transfer of this size, the weekly-wage of £97,000 per-week is relatively low. However, for Chelsea, this new approach means that their wage bill will be reduced and if it doesn’t work out for Mudryk in London, other interested clubs can meet these wage demands. This is a change in strategy that has occurred during the Chelsea and Boehly era, since the £325,000 per-week contract given to Raheem Sterling in summer 2022. For Mudryk, this contract still appealed to him as it gives financial security to him until he passes the age of 30, despite the fact he may have been able to receive a higher weekly salary over a shorter contract length elsewhere. If Chelsea do want Mudryk to stay for the duration of his contract, this approach also puts them in a good position as it makes it difficult for other clubs to buy him out of such a long term contract.

Other examples of this strategy are:

| PLAYER | CLUB | CONTRACT LENGTH (years) | Total Transfer Fee | Annual Payment |

| Wesley Fofana | Leicester | 7 | £80m | £11.4m |

| Benoit Badiashile | Monaco | 7.5 | £32m | £4.2m |

| David Fofana | Molde | 6.5 | £10m | £1.5m |

| Marc Cucurella | Brighton | 6 | £65 | £10.8m |

There are signs that Chelsea are aware that they cannot just continue to expand their squad endlessly however. With the departure of Jorginho (£12m) to Arsenal on January deadline day as well as rumours around highly-sought-after players such as Hakim Ziyech (who had a failed loan to PSG) and Conor Gallagher can slightly help Chelsea work towards balancing the books in the near future. Perhaps one important thing to also note at this point is that Chelsea’s famous Cobham academy has amassed almost £100m from the sales of Tammy Abraham, Marc Guehi and Fikayo Tomori in recent years. However, these sales were made before Boehly’s takeover and cannot be attributed to his business plan.

The Future and How Have UEFA Reacted?

At the moment, the full extent and impact of such a unique and unprecedented strategy is yet to completely materialise. It can be labelled as an ongoing experiment in football and is being closely monitored by other clubs. It is unclear whether other clubs will follow suit and attempt to adopt similar business models moving forward. Perhaps the only comparison that can be made at the moment is the activity of Nottingham Forest since summer 2022. They have recruited 22 players during this period, although their circumstances are significantly different following their promotion from the English second tier and their bid to remain in the Premier League.

Some experts have pointed to the long-term consequences of the business strategy as a point of hesitation for other clubs. The spread of payments over almost the next decade will accumulate and may eventually limit the scope of expenditure of Chelsea in the future, particularly if some of their recent signings do not play out as expected or hoped.

Another hindrance to other clubs mirroring this modern approach to transfers is that Boehly’s intelligent redistribution of finances to avoid any risk of breaching FFP regulations has instigated a quick response from UEFA. UEFA have stated they will implement a new restriction as part of Financial Fair Play which limits the distribution of a transfer fee to over a maximum of five years. In other words, clubs are still permitted to sign players on longer contracts, such as Mudryk’s 8.5-year deal; the new rule alteration will mean that the club will have to pay the transfer fee in the first five years of the contract. In practice, if the total fee was £100m, the club would owe £20m per year in instalments and must have paid this in full by the end of the fifth year of the contract, or they risk being faced with FFP penalties and punishments.

Summary

Chelsea’s recent activity in the transfer market since the takeover of Todd Boehly’s consortium has made for fascinating viewing for football fans and experts alike. The unprecedented total expenditure over the last two windows has raised many questions amongst the footballing world and highlighted a key loophole in the FFP regulations. Moving forward, it will be an interesting strategy to follow and to see whether or not UEFA are able to prevent such business models and if clubs are able to reflect Chelsea’s approach or even to exploit other flaws in the regulations to benefit their own transfer strategy.

Further Reading

BLOG: What Does Todd Boehly’s Consortium Bid Mean for Chelsea?

BLOG: The Winter Transfer Window – A Football/Soccer Agent’s Perspective

BLOG: Who Benefits the Most from UEFA’s New Financial Fair Play Regulations?